The Bitcoin Standard

One to Rule Them All

The Observer

The world is changing, old orders are coming down, old goals and values re-examined, and a whole lot of trouble is coming.

Born in 2000, I've been alive to experience some of the most interesting modern history we've seen. I caught the trail of the Dot Com bubble bursting, I was alive for the change that 9/11 produced, my dad went to Iraq, in 2008 I also watched friends and family through the Financial Crisis.

I left school just as the Me Too movement invaded every relationship and sterilised inter-gender dynamics. I witnessed Marxist revolutionaries actively work to dismantle my society, doing profoundly revolutionary things like gluing themselves to roads, as the elders of my society just watched.

I lived through those same elders a few years later completely shut down my society for a disease with about a 1% mortality rate, watched small businesses be closed under the threat of incarceration, and yet I could still have the exact same products delivered by Amazon.

In trying to figure out the seemingly generational lack of care and interest in upholding and maintaining the customs of your country, I was naturally pushed toward - following the money.

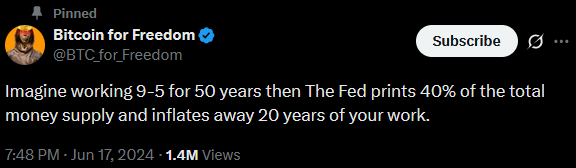

For you to truly understand where we are in the world, you must understand the massive changes of our society that our elites and establishments have tried their very best to cover up. To me the most solid evidence for our misery today comes from the money supply.

The Field

https://wtfhappenedin1971.com/

Have a scroll, you don't need to be thorough, but have a look at that website.

What you might notice is that our societies (specifically the U.S. on that website, but many others) began to change profoundly for the worst in 1971.

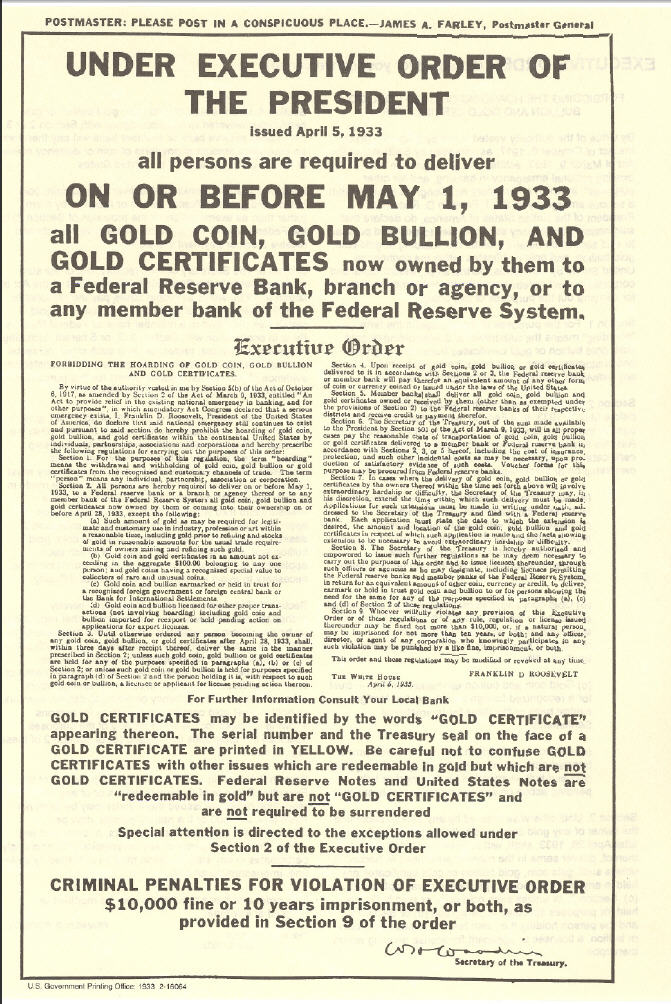

What happened in 1971 was the end of the Bretton Woods agreement, a post-World War II monetary system that established fixed exchange rates for global trade, involving countries worldwide. The United States ended the gold convertibility of the U.S. dollar, a decision known as the Nixon Shock. Before this, $1 USD was worth approximately 1/35th of a troy ounce of gold (0.02857 ounces or 0.8883 grams), and foreign central banks could exchange dollars for gold at the Federal Reserve. Under Bretton Woods, other currencies were pegged to the U.S. dollar at fixed exchange rates, fostering stability in international trade and finance. The U.S. ended the dollar’s gold convertibility in 1971 to protect dwindling gold reserves, address trade deficits, manage fiscal debts from Vietnam war spending, and gain flexibility to expand the money supply (total amount of dollars actually available).

In order for trade to grow and other nations to join this world order they must be able to trade freely, in order to trade freely they need a currency to do so, otherwise they are just trading goods (chicken for bread) which is bartering. In order for those countries to be able to trade in USD, the United States must take trade deficits - essentially moving their industrial bases to other places, where goods are made, and then traded back to the US, for USD. That's how those countries are to obtain USD in a global system. In essence, USD needs to flow out from of the US not towards it.

In the short term, unpegging the dollar from gold allowed the U.S. to expand its money supply, which, over time, reinforced the dollar’s dominance as the global reserve currency and attracted capital flows through demand for dollar-denominated assets like Treasury bonds. The dollar was already the reserve currency under Bretton Woods, but this shift to a fiat-based system solidified its role due to the U.S.’s economic and military influence. This gave the U.S. significant influence over the global economy through tools like Federal Reserve monetary policy and issuance of dollar-denominated debt.

It was this decision to remove the convertibility of the Dollar to gold, that moved the USD from money, to currency.

You can store your life saving in money, but not in currency. Money is currency, but not all currency is money. Gold is money, because everyone would take gold for their work or products, but while Kenyan Shilling is currency, to anyone not Kenyan, its not really usable money.

Money is something people will accept in exchange for goods or services. It is THE store of value.

Currency is the part of the money supply that you interact with like coins and notes.

Humans have looked for many ways to store their hard work and toil for the future throughout our time: livestock, grains, shells, beads, spices, salt, cloth, copper, bronze, silver, and of course gold. In doing so they become not only stores of value, but a medium of exchange, i.e. you can work for beads or salt, but also transact with beads or salt. For most of our history this worked pretty well, although there are significant flaws in these systems.

The main downside of money is that they are usually cumbersome to hold on your person, gold is quite heavy and coins stack up. They can be cheated, more shells can be found, more grain harvested, more gold mined and minted. Most importantly, whoever controls the creation of the currency controls essentially everything. They control who receives the currency, where it goes, and how much of it exists. The true power lies in controlling the ratio between real-world value and the currency supply—because whoever manages that ratio decides how much your time, work, and savings are actually worth.

Gold was a pretty good system for most of human history, traditionally there was a 2% inflation rate because about 2% of the gold supply would be added from new mining every year. As banks started to collect more and more gold in their vaults, there needed to be a way of transacting with that value, but without the cumbersome nature of carrying gold everywhere. This is where the first bank notes come from, bankers would create custom notes with their smithing logos on it as equivalent/tradable for the specified amount of gold on the face of the note. Instead of pouches or chariots of gold, you'd just have a small wallet of papers.

As the system matured, it didn’t take long for the more opportunistic side of human nature to exploit it. Bankers began issuing paper notes claiming to represent gold reserves they didn’t actually hold. This practice became known as fractional reserve banking—where banks are only required to keep a fraction (often around 10%) of deposits on hand as reserves, while lending out the rest.

This is the root cause of bank runs: once depositors realised their bank had issued more claims than it had gold, they rushed to withdraw their savings before the vault was empty—before they were left holding worthless paper from a collapsed institution.

Most of human banking operated on a single-entry system: people deposited physical gold, and the bank issued a note as a claim on that gold. But when we moved off the gold standard, we also shifted into a double-entry accounting system. Now, banks don't need to hold an underlying asset like gold to issue money. Instead, they create money by simultaneously recording a credit and a debit in their books—money is created not from value, but from agreement. It's debt, just an IOU.

Let’s say a friend wants me to fix his roof. He offers me $10, and I agree. We shake hands—I start work next week. He records a $10 credit to me in his ledger, and I record a $10 debit in mine. No real value has changed hands yet—the money exists only as a mutual accounting entry. That’s the core mechanic of fiat banking. It's not backed by physical value—it's created through trust, entries, and promises.

You, with your USD.

The Matrix

I think its clear that the Western world is currently dealing with a serious cultural subversion by our elites. I believe most people at this point, either consciously or unconsciously, are aware that this is plainly a form of class warfare. Rich vs Poor.

- Oh you can't say that because you haven't been trained in this very niche HR schooling only I can because I've got the education.

- We need to trust the experts, not people who just read a few books on their own.

- That’s misinformation. You’re not a certified public health official, so your opinion doesn’t count.

- You’re not allowed to question this policy—you don’t have a PhD in gender economics.

I have watched as pinnacles of freedom used the global financial system as a tool for coercion and control. In Canada, during the 2022 Freedom Convoy protests against COVID-19 vaccine mandates, Prime Minister Justin Trudeau invoked emergency powers to freeze the bank accounts not only of truckers participating in the protest, but also of individuals who donated to their cause. In China, the Henan Bank protests saw citizens unable to access their savings, with accounts frozen amid allegations of corruption and mismanagement. And when Russia invaded Ukraine, approximately $300 Billion in Russian assets were frozen globally as part of sweeping sanctions, signalling how financial systems can be weaponised at both individual and state levels.

You don't own anything - you're allowed to. If you get a parking fine, and don't pay it, it attracts more fees, then notices, then eventually a court date, then they start taking things from you, until you don't have a house or family.

The Whitepaper

In 2009, a mysterious and deceptively simple 9-page scientific white paper was published, titled Bitcoin: A Peer-to-Peer Electronic Cash System, by a man called Satoshi Nakamoto. At first, few realised the seismic shift it heralded—Bitcoin’s release is a once-in-a-species level event, rewriting the rules of money forever.

We still have no idea who Satoshi Nakamoto is, it's literally just a name.

Technically, Bitcoin is a program that runs simultaneously on thousands of computers worldwide, all working together to process and verify Bitcoin (BTC) transactions. These computers form a decentralised network, cryptographically validating every transaction without needing a central authority (like a bank or Visa/Mastercard etc...).

Every 10 minutes, the network bundles recent transactions into a new block. Each block is linked cryptographically to the previous one, creating an unbroken, tamper-proof chain—hence the name blockchain. This global ledger lives on every computer running the Bitcoin software, making it incredibly resilient and transparent.

To prevent fraud and ensure trust, Bitcoin uses a consensus mechanism that favours the longest and most computationally intensive chain. In other words, the version of the blockchain backed by the most computational power is considered the valid one. Computers on the network compete to solve complex cryptographic puzzles, and the first to solve the puzzle earns the right to add the next block to the chain — receiving a reward in BTC plus transaction fees. This process, called mining, motivates participants to keep the network secure and running smoothly.

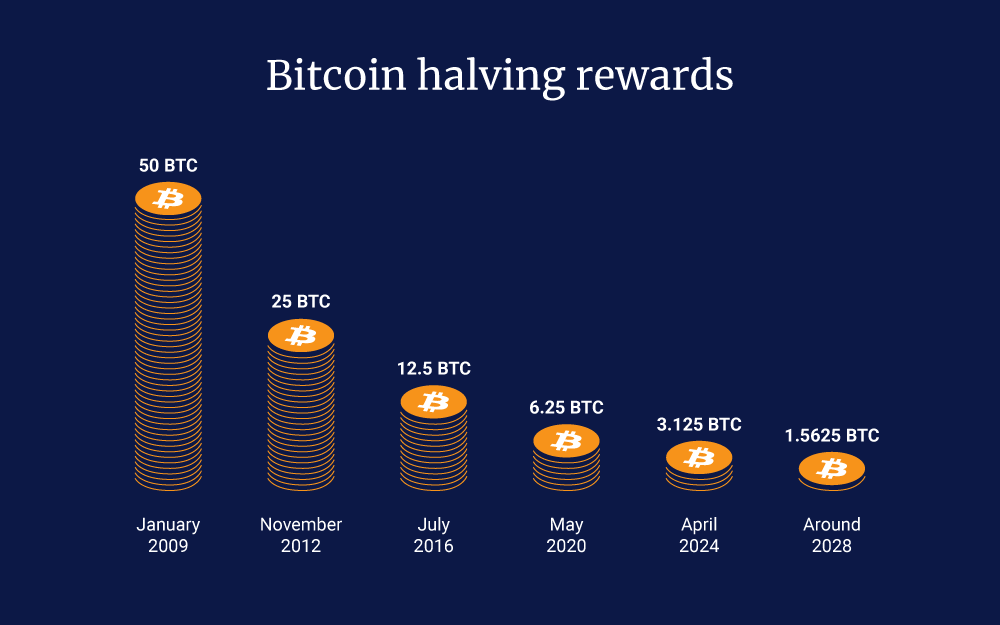

As part of this mining process, new Bitcoin is created and introduced into the system. However, this supply is not infinite—Bitcoin’s total issuance is capped at 21 million coins. This limit is hard-coded into the network’s protocol, ensuring scarcity over time. The reward miners receive for adding a block is cut in half in an event known as the halving, which occurs not just based on time but after a set number of blocks—approximately every 210,000 blocks or about every four years. This means the halving is tied to how many blocks (and therefore transactions) have been processed, gradually reducing the rate at which new coins enter circulation until the cap is reached. The BTC system goes down to 8 decimal places, so the lowest form of BTC, like a cent, is 0.00000001 BTC, seven zeros and a one, otherwise known as a Satoshi, Sat for short.

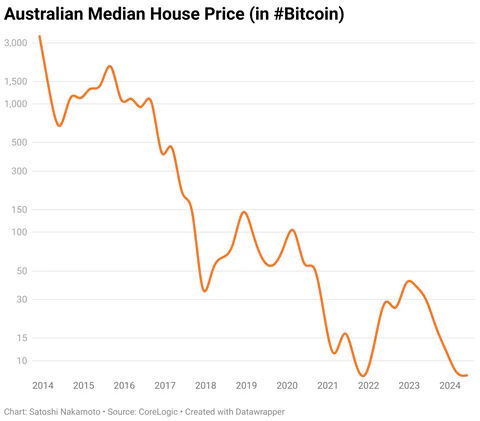

There will be a day you purchase houses for Satoshis.

By cryptographic, we mean the system relies on one-way mathematical functions. It’s easy for anyone to verify the blockchain’s integrity, but trying to alter a transaction — like adding 10 BTC to your own account — is practically impossible. To do so, you’d have to break the cryptographic security not just of that one block, but every single block linked to it, across the entire network. This makes tampering exponentially harder the further back you try to change, and more difficult as more blocks are added to the chain.

Because Bitcoin’s system is decentralised — no single person or organisation controls it — financial power is returned to individuals. Users pay small fees in BTC to move funds, enabling a trustless, borderless, and censorship-resistant way to exchange value globally.

The magic of Bitcoin is the blockchain itself. Instead of needing a bank—and their app or website—to tell me how much money I have according to their private ledger (double-entry accounting), I now only need one thing: the keys to my Bitcoin wallet. That’s it, all you need is the twelve seed phrase words and the wallet is yours.

My BTC isn’t held by a bank—it’s on the blockchain. Every transaction ever made is stored across thousands of independent computers around the globe. The network doesn’t trust an institution; it trusts math and history. To know how much BTC I own, the system simply walks back through the entire public transaction history to verify which coins were sent to my wallet and where they came from before that, anyone can do that because its a single ledger, and with computers its very quick.

I can delete my wallet from my device and as long as I have my seed words I can travel anywhere with internet and transact.

It’s money that doesn’t rely on trust. It’s money for enemies—because even people who don’t like or know each other can verify balances, settle transactions, and move value without needing a middleman to referee.

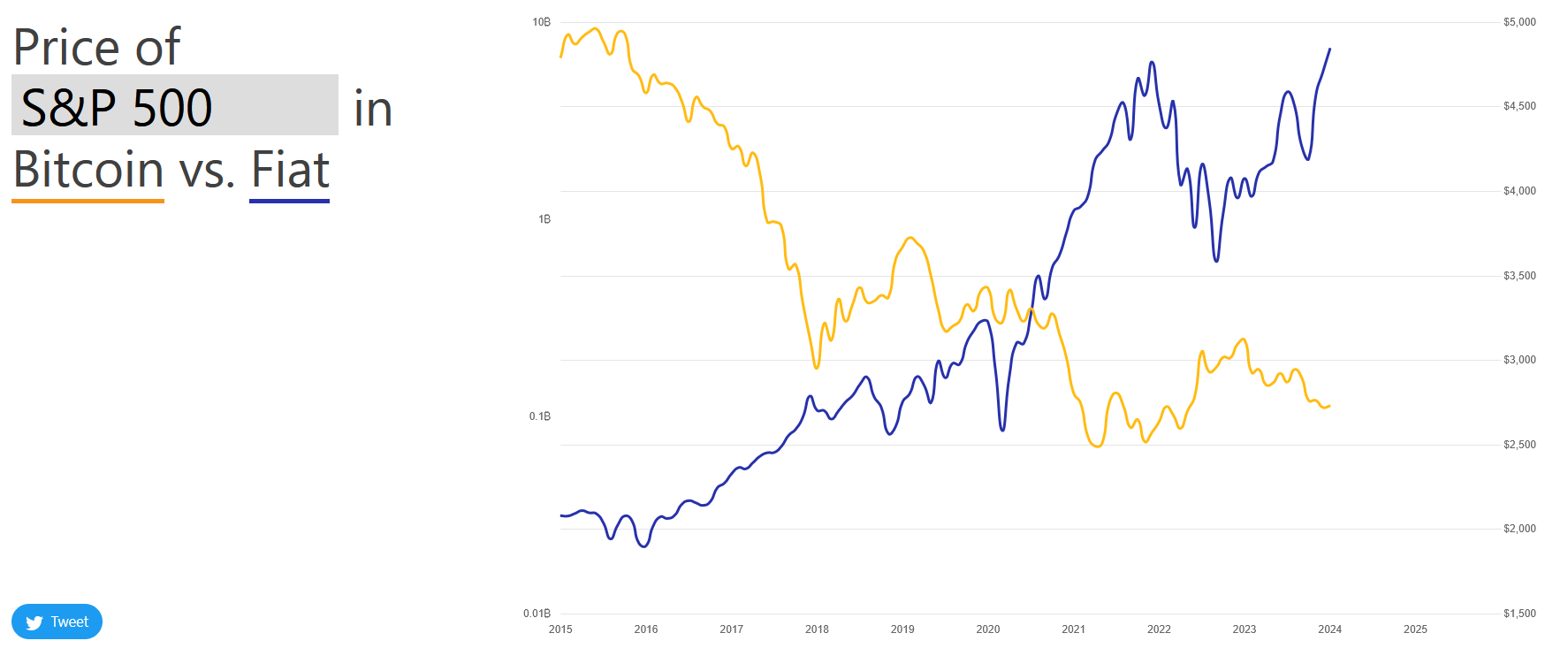

The mechanics of it being a finite thing, is that it will almost always long-term increase in price. No one can remake more BTC, no one can mine more BTC after its all mined, no one can turn BTC into jewellery or ornate objects, no one can break the network, because everyone has the incentive of keeping it running. There are companies in the US right now like Micro Strategy, that take fiat USD loans, and immediately buy BTC, because the capital growth on BTC will cover the loans - it’s money printing. They're holding down the USD trigger to get as much BTC as they can, because they know it doesn't matter, the BTC will appreciate at 100x the rate of the loan repayments. They won't ever sell. That is BTC that won't ever hit the market again in your lifetime.

Over the last couple weeks we've seen the lucrative Dollar Carry Trade start to unwind, which officially signals to me, the hyperinflation event of the USD. It’s a race to real assets, and whoever is holding the fiat bag when the music stops is the loser. Old money has started moving their wealth into gold and BTC.

You should too.

What I’m trying to highlight here, is that because BTC is finite in supply, it means that everything is deflationary against BTC. You know, like how money should work... prices should go down, we get better and faster every year right?

The Pale Horse

A component of Trump’s tariff threats and the cat and mouse game was to pressure BRICS nations into maintaining the U.S. dollar’s reserve status by forcing negotiations, often on U.S. terms - among many other things. These threats respond to BRICS’ de-dollarisation efforts, which gained momentum after the Biden administration’s sanctions on Russia post-2022 Ukraine invasion, perceived as weaponising the dollar. Since then, BRICS nations, including China, have significantly increased gold holdings to diversify reserves, contributing to a broader trend of gold flowing from Western to Eastern markets. If gold is real money - we're loosing.

Recently the United States have started talking about a strategic reserve of Bitcoin, a few countries have started using it for basic transactions (I imagine these nations will be very wealthy in future), companies have started the fiat printers to get more BTC, its a race to the bottom, and there is only 21,000,000 coins, they have to represent all value of the human race, all banking, treasuries, war debts, real estate, gold, everything. Just wait till the banks, corporations, and countries start using BTC.

The secret sauce to all investments is time. You don't need to time the market, all you have to do is regularly buy BTC in whatever amounts you can afford (this is called Dollar-Cost Averaging). Do that for a couple years and you'll likely see it as the best investment path you have as a human being.

What I'm trying to tell you is that BTC will infinitely increase in value - there is no limit for the price of a bitcoin, in theory its priceless. You haven't missed anything, you just haven't bought any yet. When most people first heard about bitcoin they saw the price and imagined they missed the profit, so they went into other cryptos to try and gamble their way to a BTC-like growth rate, if only they had have just bought BTC they would have BTC like growth rates.

If you've been lead to this, and you've gotten this far, I would be willing to gamble that forces unseen are trying to communicate something with you, you are one of the people that gets to hope on. Start buying. When you get to an amount you would be upset at loosing, start looking into self-custody. Not your keys, not your coins. MANY exchanges have collapsed/rug-pulled.

God speed.